Retirement planning just got

Simplified…

Retirement Simplified Toolkit*

Access to our toolkit is a just a text and download away!

*As seen on The East TX Retirement Report.

Feliciano Financial works with friends and neighbors throughout the greater Tyler area to create a plan that works for their financial goals.We are deeply rooted in the East Texas community and have developed our business by creating close, personal relationships with our clients. We aim to help you address your financial concerns and create a plan for the future.

Simplify your retirement planning today.

Call or Text “BLUEPRINT” to 903-522-4885

or complete the form below.

In doing, you will receive exclusive access to our Retirement Simplified Toolkit!

What’s Included in our Retirement Simplified Kit

Retirement Insights

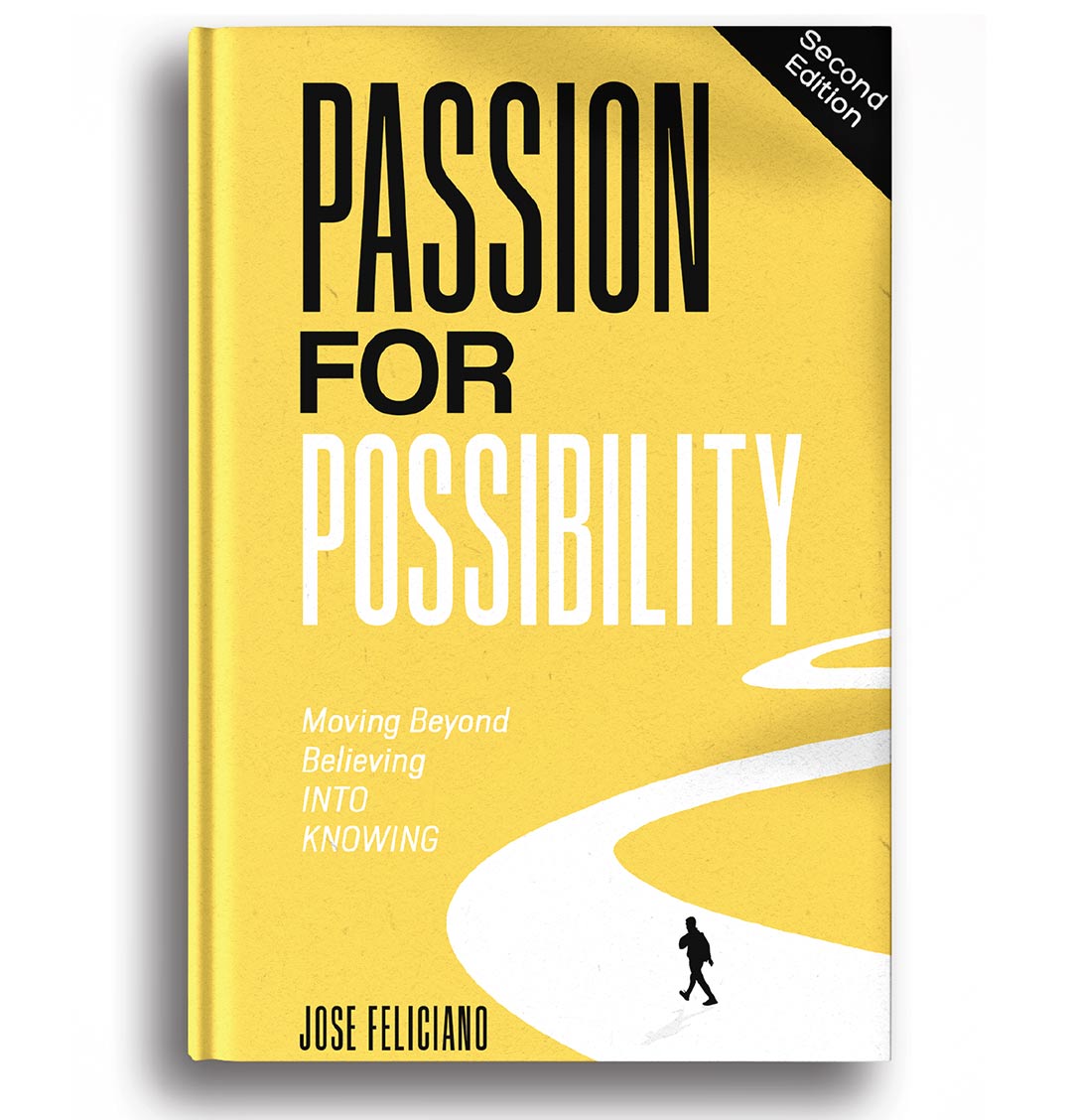

Author's Book

Digital Downloads

We are excited to share our Retirement Simplified Toolkit, which offers exclusive access to the following:

- Passion for Possibilities, Second Edition Book written by Feliciano Financial Founder, Jose Feliciano

- 2022/2023 Tax Sheet

- Top financial insight guides and additional media

- Digital Downloads

One of East Texas’ Premier Financial Planning Firms

Our mission is to inspire and motivate people to be proactive and to live their lives on purpose. We are proud to have served from our home in Tyler for over 30 years.